New Study from Harvard and Stern Business School Affirms the Value of Patents for Startups

Inquisitor - A new study of patents and their effects on business claims that the U.S. patent system has significant benefits for start-up businesses. “The Bright Side of Patents” by Joan Farre-Mensa of Harvard Business School, Deepak Hegde, and Alexander Ljungqvist of New York University’s Stern School of Business found that the employment and sales growth of U.S. startups was enhanced by patents.

Their research focused on first-time patent applications filed in the U.S. by startups since 2001 that received a preliminary decision by 2009 and a final decision by the end of 2013. The total number of patents surveyed was 45,819.

The study found that approval of a startup’s first patent application increased its employment growth over the next five years by an average of 36 percent, and its sales growth by 51 percent. Approval of a patent application increased a startup’s probability of securing funding from VCs over the following three years, and patent grants more than doubled the probability that a startup is eventually listed on a stock exchange.

Conversely, each year of a delay in reviewing a firm’s first patent application that was eventually approved reduced the firm’s employment and sales growth over the five years following approval by 21 and 28 percent. Delays even reduce the probability of going public by as much as a half for each year of delay. A two-year delay has the same negative impact on a startup’s growth and success as the outright rejection of a patent application.

How the patent system affects the start-up community is one of the most debated aspects of patent reform in the U.S. The pro-reform side warns of the risks posed by infringement litigation to small businesses, and questions the overall value that patenting brings, while the other side insists that patent filings are a crucial part of a company’s ability to realize return from patent R&D investments and ultimately compete against larger competitors.

This research into startups has coincided with a report by the U.S. Labor Department on the number of new company formations and the jobs they create. There were 232,000 establishment “births” in the second quarter of 2015, but as a share of the overall labor market, the number of jobs attributed to such births has fallen since before the recession, with a decline in particular among high-growth young firms in the tech sector.“Something has happened to the incentives or the ability to be a high-growth firm in the high-tech sector” according to study authors Ryan Decker, an economist at the Federal Reserve, Ron Jarmin and Javier Miranda, economists at the Census Bureau, and John Haltiwanger, an economist at the University of Maryland.

The number of fast-growing startups has been falling since 2000. As Rachel Craig, startup advisor at Quality Formations Ltd, points out startups face many challenges in their early stages such as access to finance which can play a huge role in successful launch, and overheads that have the “ability to make or break even the most promising startups, meaning they never have a chance of getting into profile let alone become the successful businesses they potentially could be”.

Startups failing have a wider impact on the health of an economy, fewer jobs at dynamic new companies, and also a constraint on the kind of technological diffusion and assimilation that can accelerate productivity gains across an economy as a whole.

One reason to be optimistic, though, is the economic slowdown in China, which is providing new opportunities for tech startups with many companies based in Silicon Valley finding easier and less costly ways to make products in factory cities like Shenzhen. The decline of demand in China’s domestic market has meant factories that used to rely on big volume and low margin orders, are operating under capacity. As a result, these factories are more willing to take smaller orders, exactly the kind that suits startup businesses.

In the U.K., where shared culture and language means tech startups can be just as important as in the U.S., a number of schemes have been announced this week to give such companies a boost.

The new Tech City initiative ‘Upscale’ will see 30 companies that have been founded within the last six years and achieved at least £1m (about $1.42m) turnover or raised significant funding will receive mentoring from a group of the country’s most successful tech entrepreneurs, and access to workshops on topics such as international expansion, HR support, and building a fast-growth company.

The U.K. government has announced the launch of an early-stage accelerator program which will offer support to cyber security startups. The U.K.’s cyber security industry has grown by 70 percent since 2013 to hit £17.6 billion (approx. $25 billion). Funded by the Government’s National Cyber Security Programme, it will seek to identify and support firms that are not yet fully developed enough to secure investment independently. and make it easier for innovation to develop into commercial success.

Read more at inquisitr.com

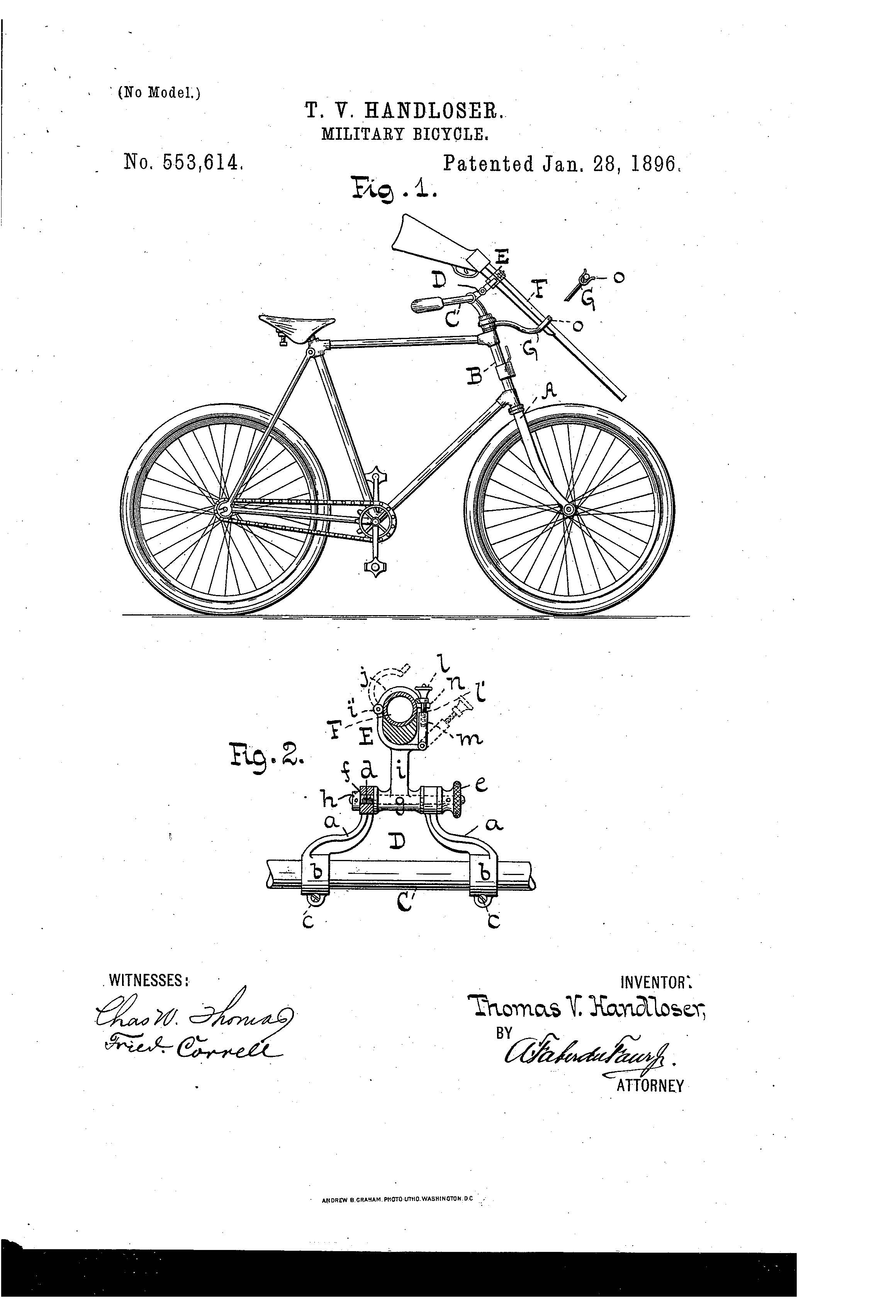

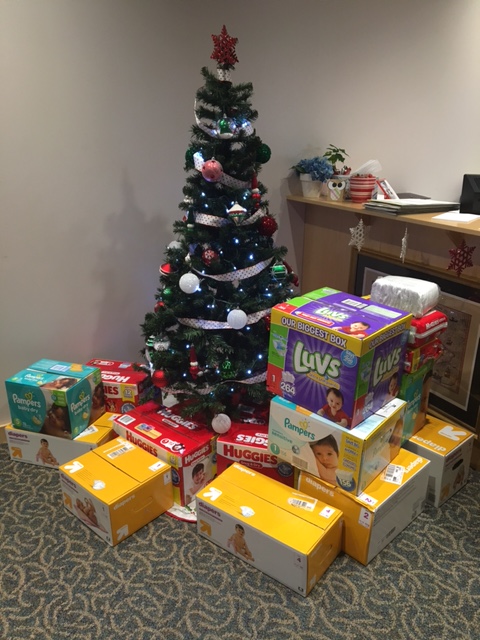

Patent of the Day: Military Bicycle

On this day in 1896 Thomas V. Handloser was granted the patent for Military Bicycle. U.S. Patent No. 553,614.

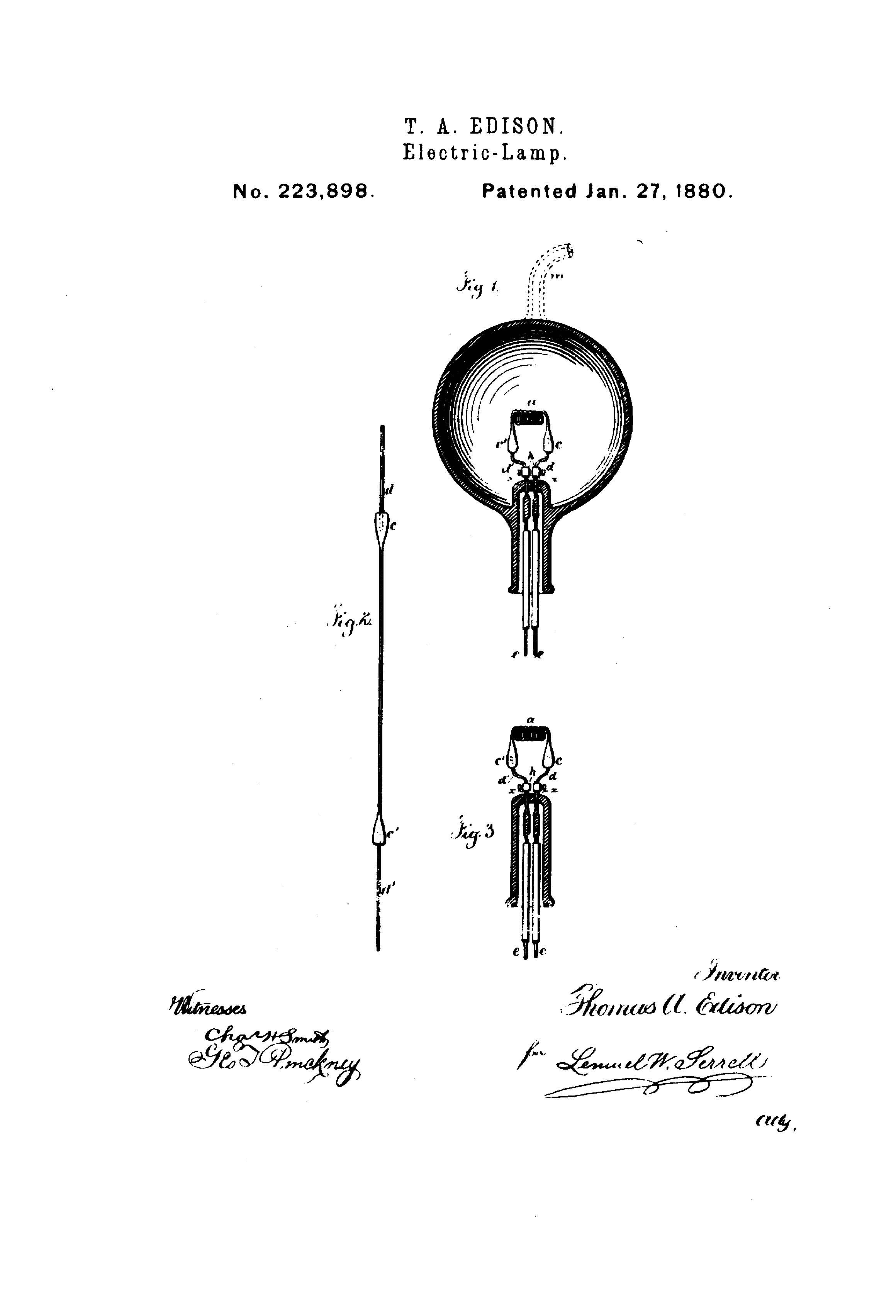

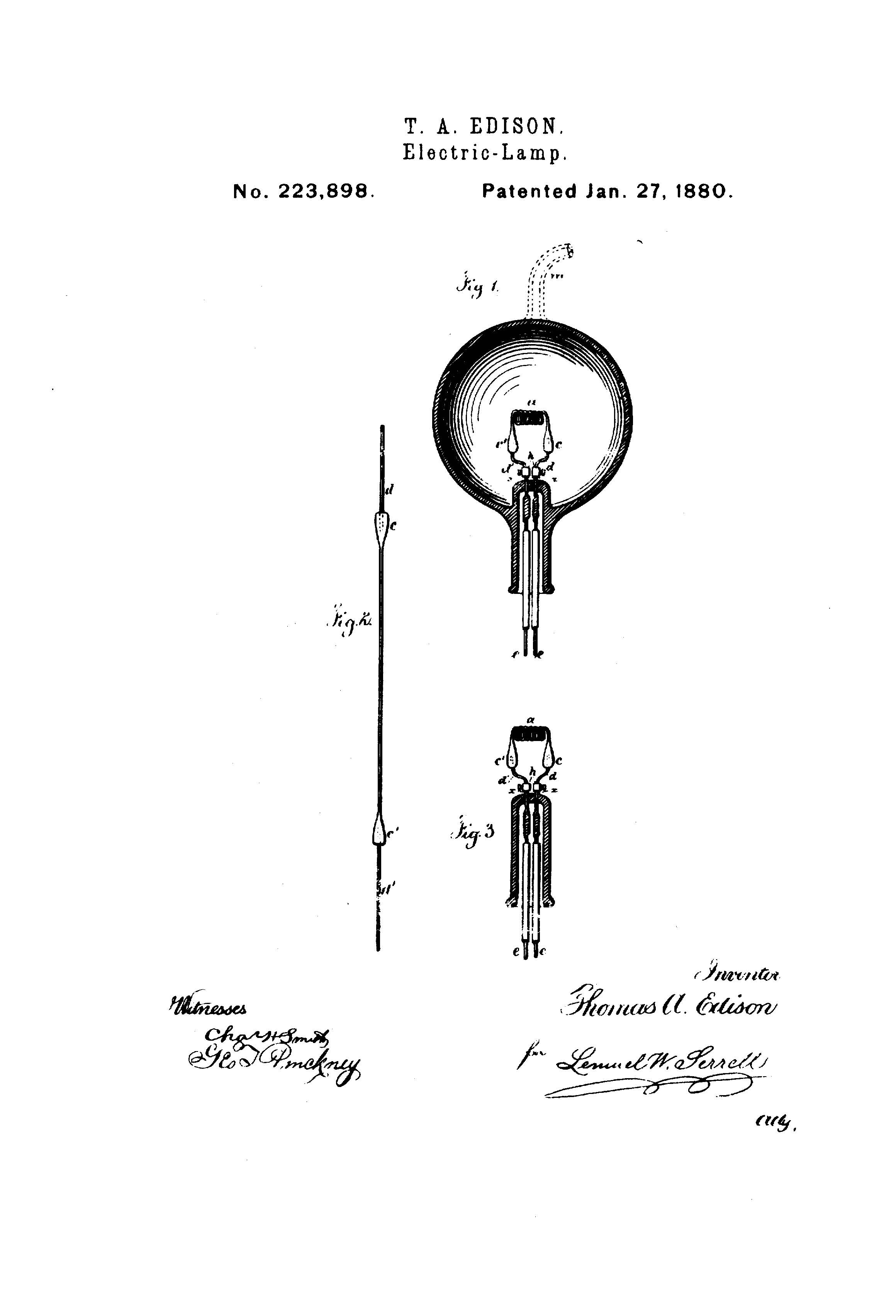

Patent of the Day: Electric Lamp

On this day in 1880 Thomas Edison was granted the patent for his Electric Lamp. U.S. Patent No. 223,898.

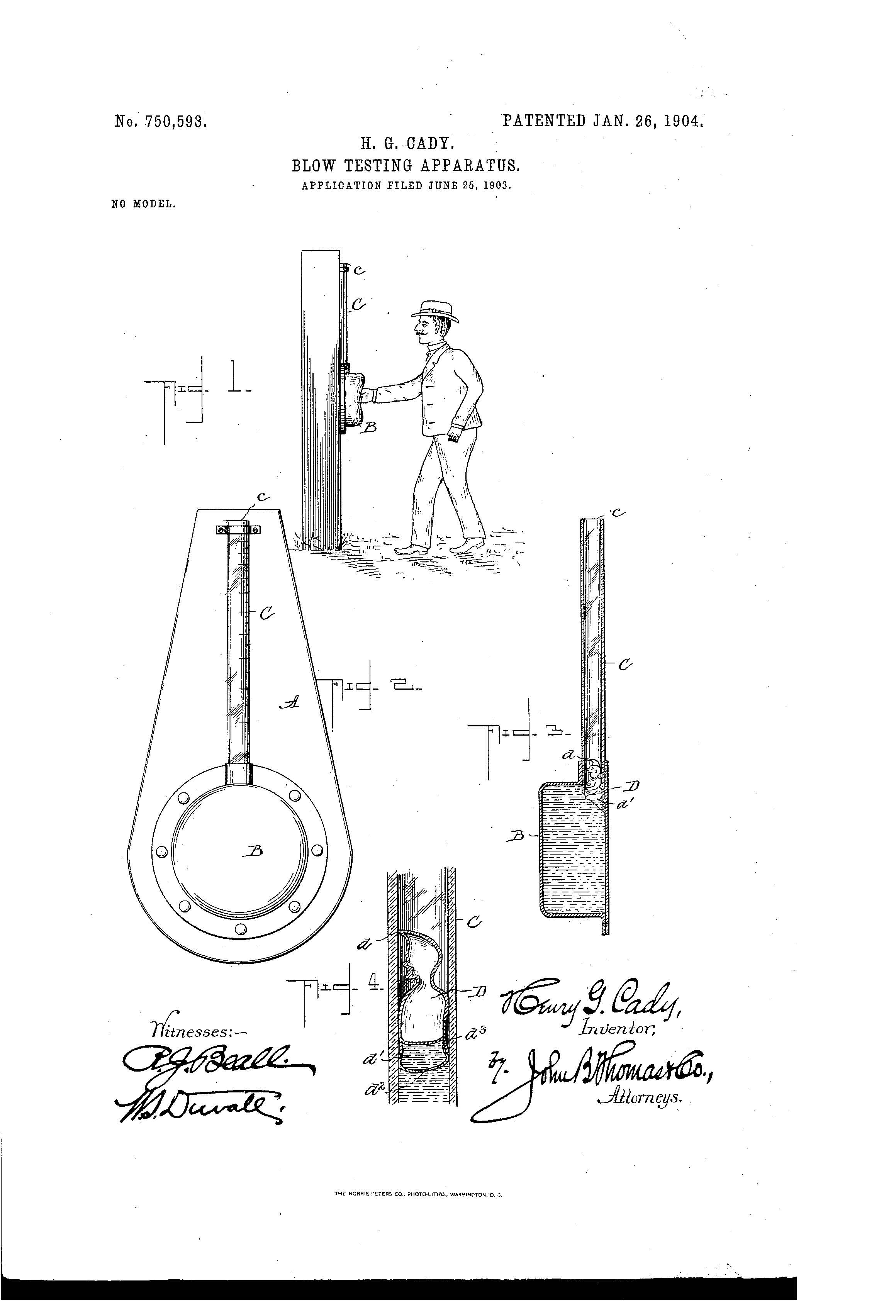

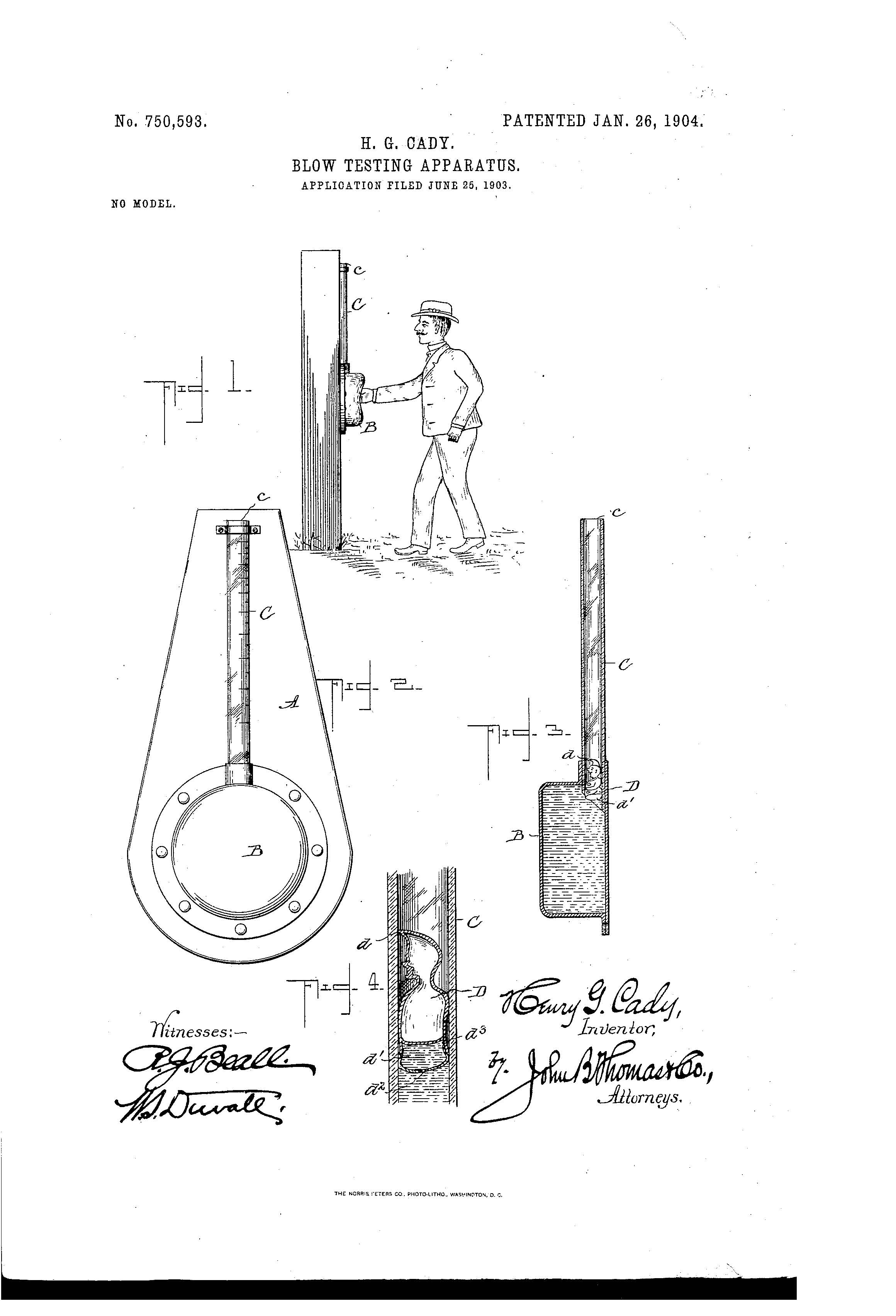

Patent of the Day: Blow Testing Apparatus

On this day in 1904 the patent for Blow Testing Apparatus was granted. U.S. Patent No. 750,593.

The object of this invention is to provide an apparatus for testing the punching or hitting power of the arm.

Matthew Poulsen to discuss Patent Law at SDSU 1-27-16

Our own Matthew Poulsen will be discussing Patent Law at South Dakota State University, Wednesday, the 27th at 1:00pm.

Patent Policy and the Promotion of Job Growth

Patents stifle innovation.

Patent trolls are the modern day robber barons.

All patents are acquired by large corporations who operate to destroy small businesses.

These statements reflect the views of many individuals regarding patents and patent owners. Whether you agree or disagree with these statements, I have no intention to change your mind. However, there is one aspect of patents in which I would like to discuss, namely the effect of patent policy in the promotion of job growth.

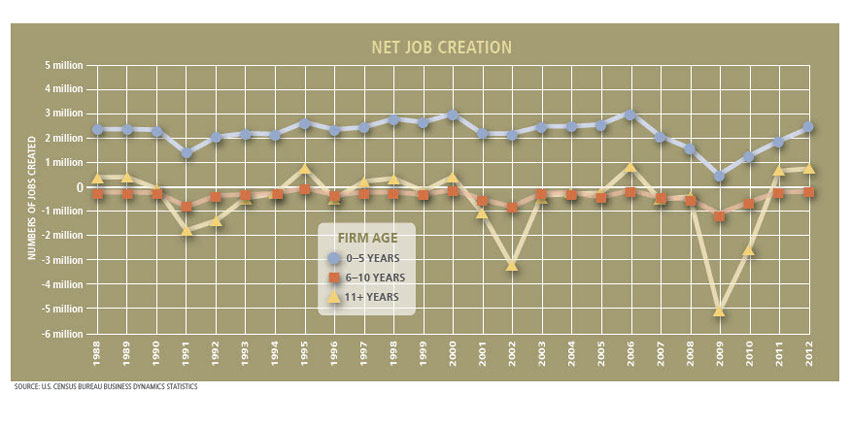

New and young companies, generally referred to as startups, are the primary source of jobs in the United States. Startups are commonly considered to be those companies in existence for less than six years. The chart below details net creation of jobs amongst companies of different ages from 1988-2012 where companies of an age of 0 to 5 years have consistently led net job creation, even in the post dotcom crash of 2001 and post housing crash of 2008. This chart is reproduced from The Importance of Young Firms for Economic Growth by Jason Wiens and Chris Jackson of the Ewing Marian Kaufman Foundation, September 13, 2015.

Among all startups, high-tech startups are particularly important for job growth. High-tech companies between one and five years of age created a net 16,700 jobs in 2011 according to Paula Dwyer of Bloomberg, The Only Startups That Matter to Job Creation, August 16, 2011. High-tech companies, in addition to their job growth, provide additional economic benefits, which include technology development and the introduction of new products and new features.

How can patent policy affect job growth, and why are patents important for the success of startups? It is widely accepted that if companies wish to become profitable over a long period of time, economic barriers to entry are needed by the firm to thwart competition. Economic barriers to entry are obstacles which hinder the movement of companies into an industry. These barriers may include legal restrictions (e.g. only one retailer can sell food concessions at a venue), technical superiority, economies of scale, large initial capital investment, control of a resource, and patents. However, most of these economic barriers to entry may only be acquired by large companies with many resources which may not be available to startups. Patents are one type of merit-based barrier to entry that is available to startups and may be effectively employed to improve a possibility of long term profitability for startups.

Consequently, patent policy should operate to allow the protection of intellectual property developed by startups to promote job growth. One example of current patent policy which is favorable for startups is the enactment of the micro-entity fee structure as part of the America Invents Act of 2011. The micro-entity fee structure provides for reduced patent filing, prosecution, issuance and maintenance fees for small businesses whose inventors are named to no more than four patent applications and whose inventors do not have a gross income that exceeds the median household income for that preceding calendar year. Additional considerations for patent policy would be the removal of fee diversion at the United States Patent and Trademark Office (USPTO) to allow more efficient operations at the USPTO and a reduction in a patent application pendency of patent applications from patent application filing to issuance (the average patent application pendency is 26 months according to USPTO statistics). Companies can more effectively operate with reduced patent application pendency as they may be able to more quickly determine appropriate research and development resources and activities. Startups may be particularly benefitted by reduced patent application pendency as they may rely upon quick issuance of patents to obtain funding and venture capital assistance.

Another policy consideration is that current attempts to thwart non-practicing entities, considered in both the House and Senate in 2015 (H.R. 9 and S. 1137), should only impact abusive litigation without devaluing a patent itself. Reducing the value of patents, possibly through legislation to curb non-practicing entities, could negatively impact startups and reduce job creation. While opinions regarding patents vary significantly, startups are important for job creation and patents are important for the long term profitability of startups.

CLE by Chad Swantz: Patent Prosecution: Ethics and Conflicts 1/14/16

Our own Chad Swantz will be speaking with Tyson Benson about Patent Prosecution: Ethics and Conflicts Thursday, January 14, at the Roman Hruska law Center in Lincoln. Please see below for more information.

Patent Prosecution: Ethics and Conflicts

Thursday, January 14, 2016 • 12:00 pm - 2:00 pm CST

Roman Hruska Law Center - 635 S 14th St. - 1st floor conference room

Live attendees: Bring your own lunch, or we will provide lunch for $10

**Also available for viewing via live webcast.**

*Nebraska MCLE #118806. *Iowa MCLE #213280. 2 CLE ethics hours. (Regular/Live credit)

*Nebraska MCLE #118808. *Iowa MCLE #213329. 2 CLE ethics hours. (Distance learning credit)

Register Online or Download Registration Form

Registration Fees: $120 - Regular Registration

FREE - I paid 2015 and/or 2016 NSBA voluntary dues and would like to claim my 2 free ethics credits.

$90 - (25% discounted price for NSBA dues-paying members) (I have already claimed my 2 free ethics credits)

$10 - Law Students

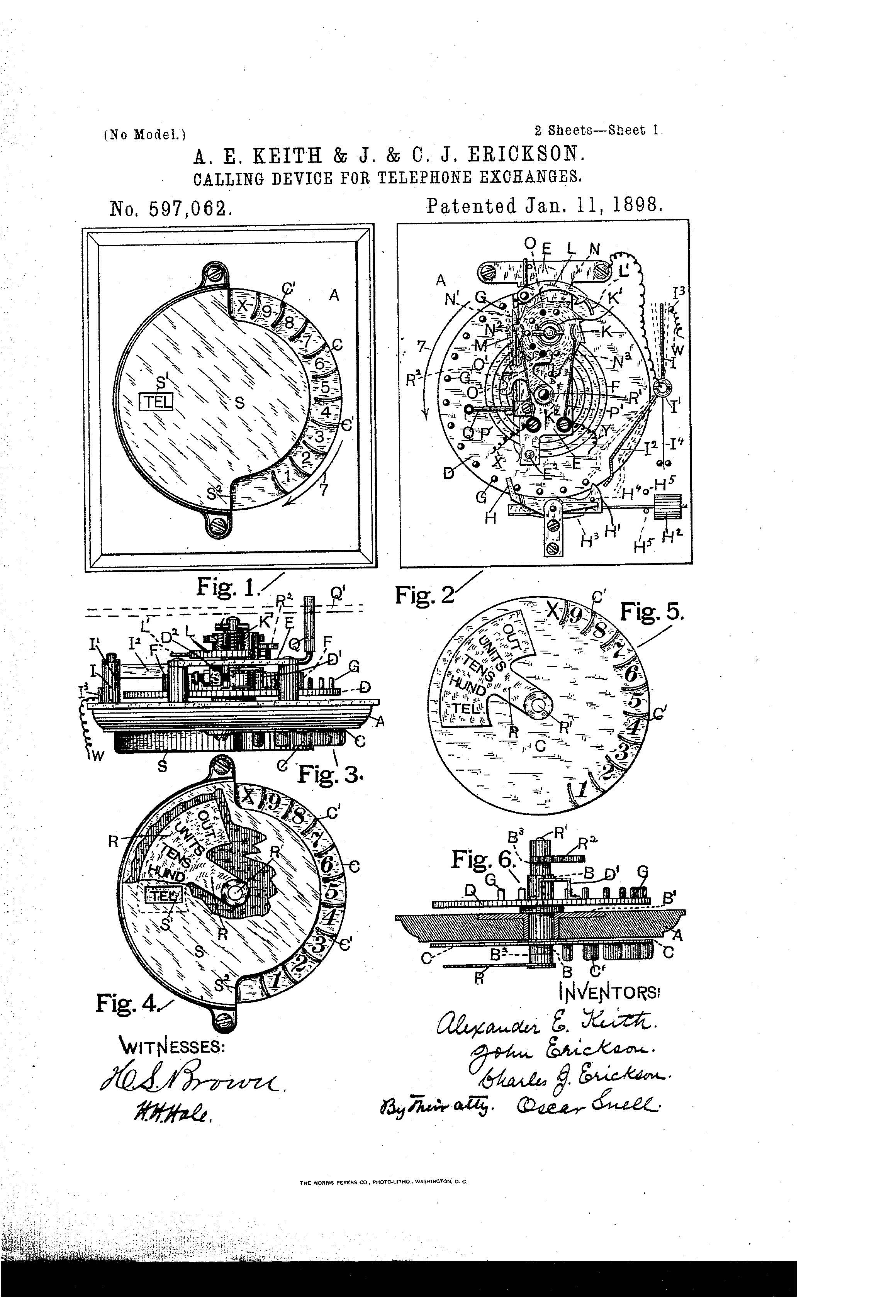

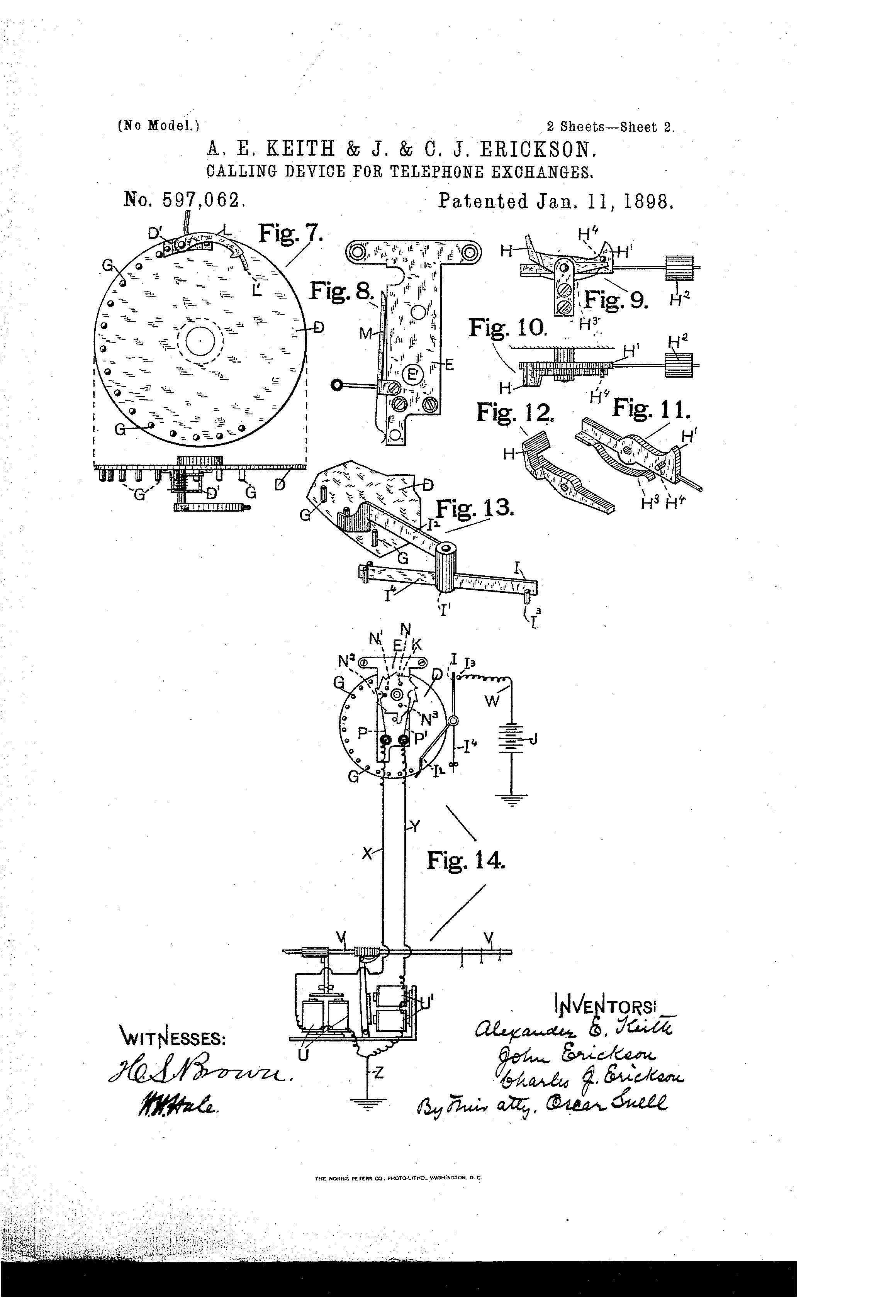

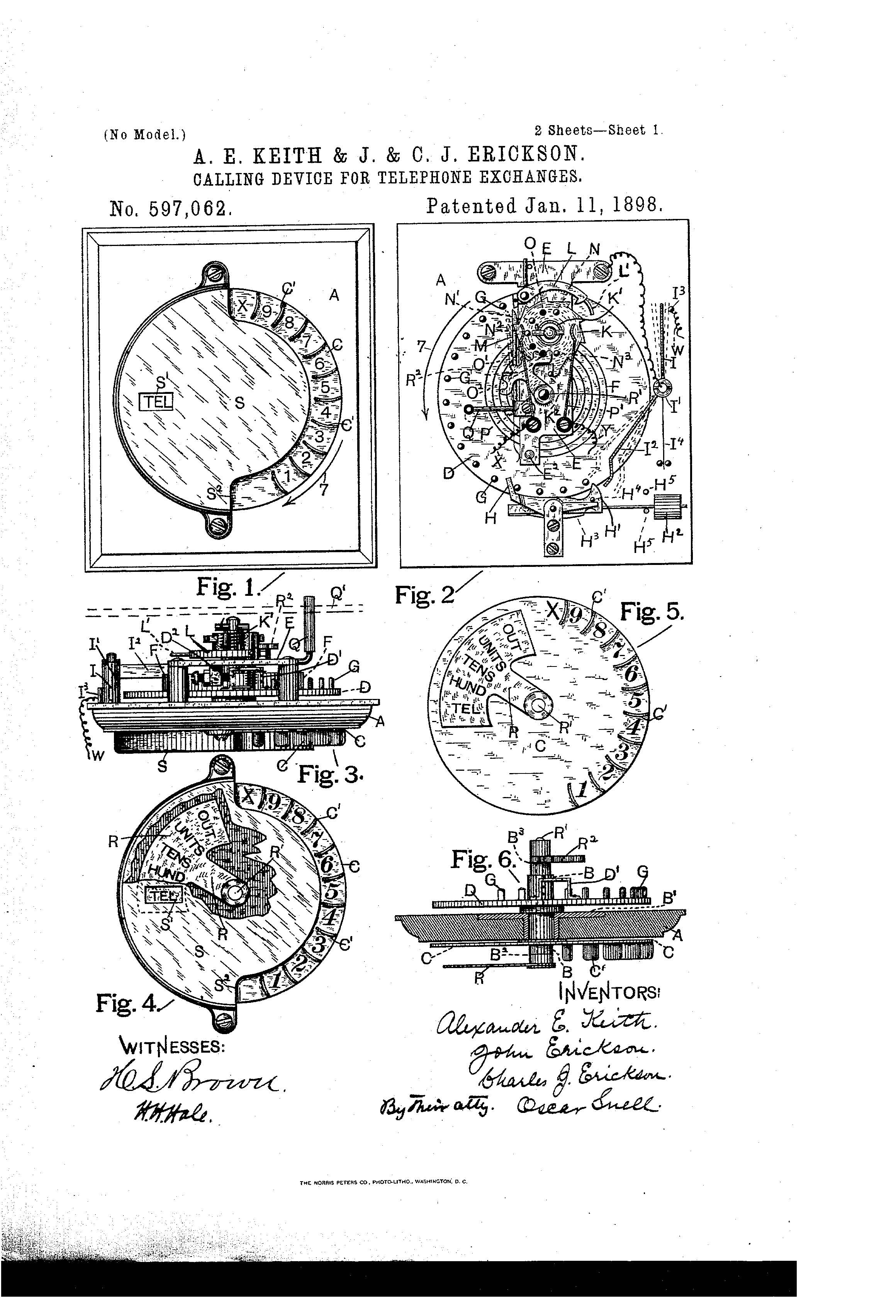

Patent of the Day: Calling Device for Telephone-Exchanges

On this day in 1898 the patent for Calling Device for Telephone-Exchanges was granted. U.S. Patent No. 597,062.

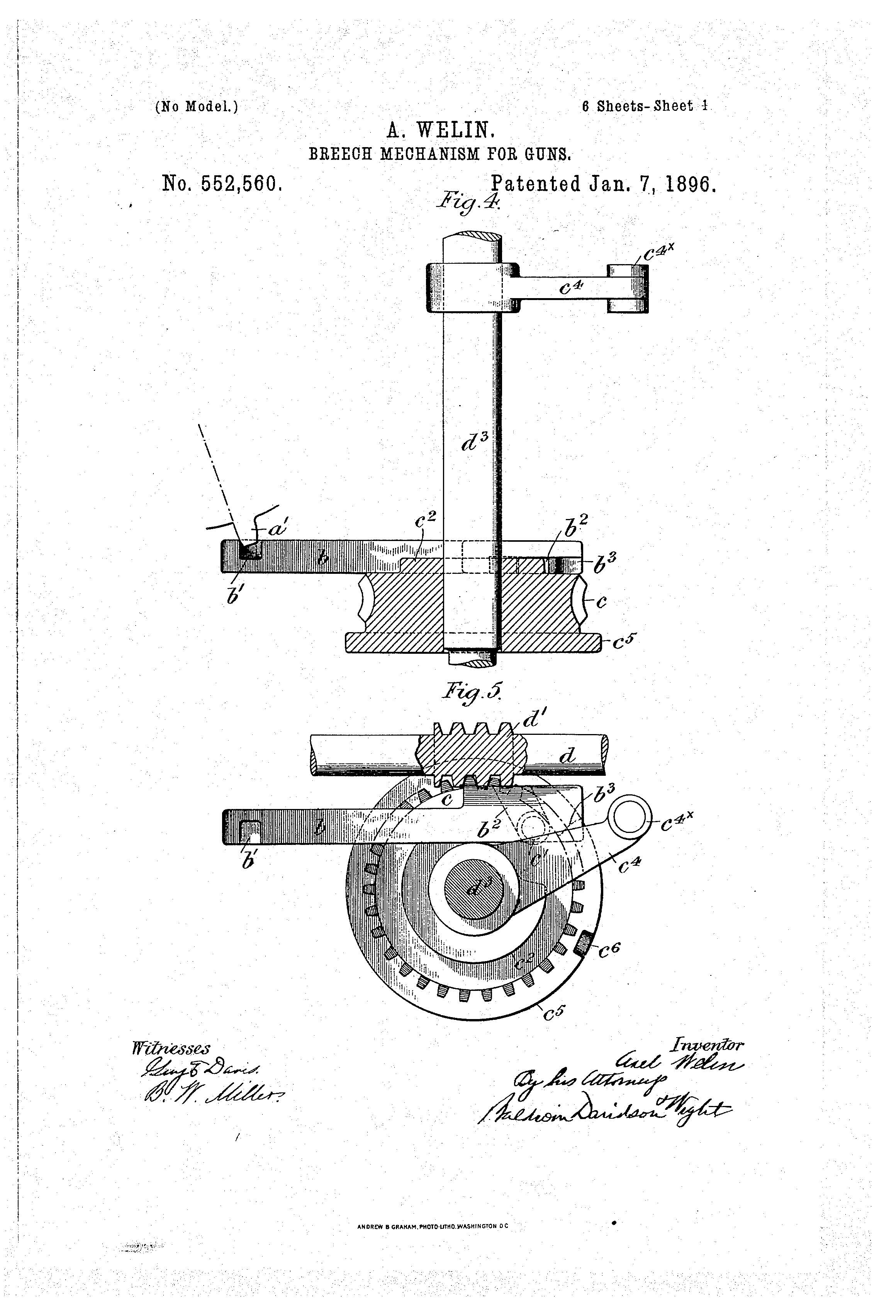

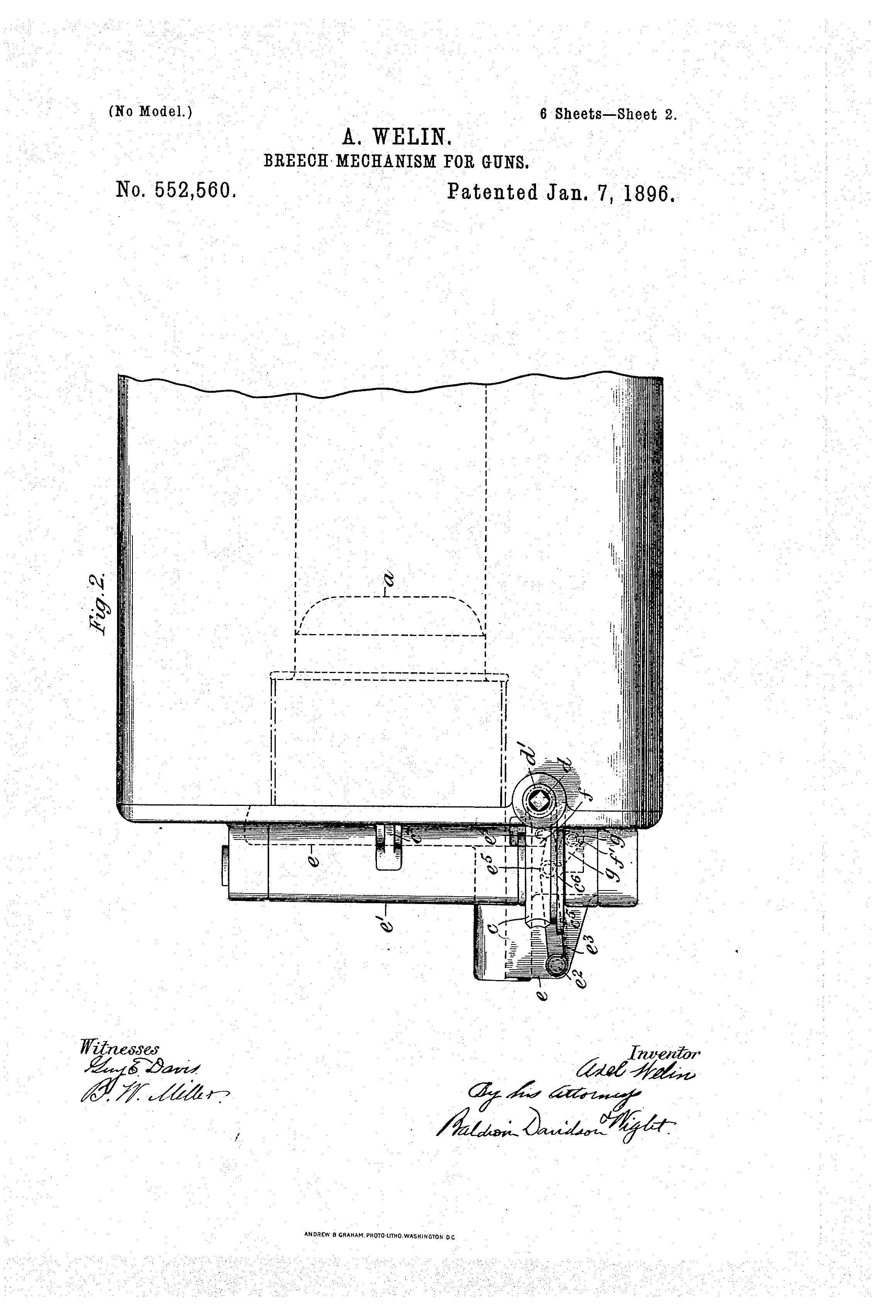

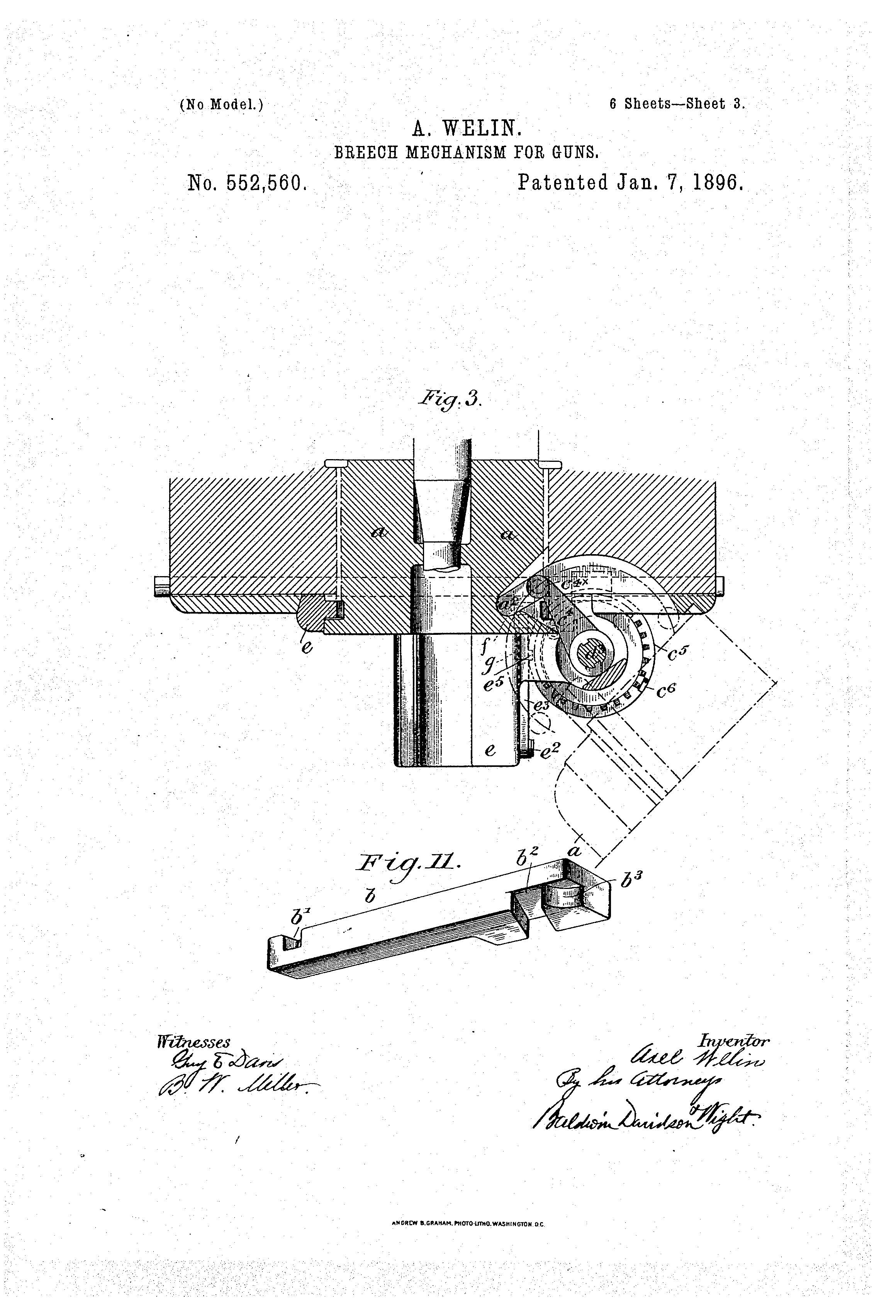

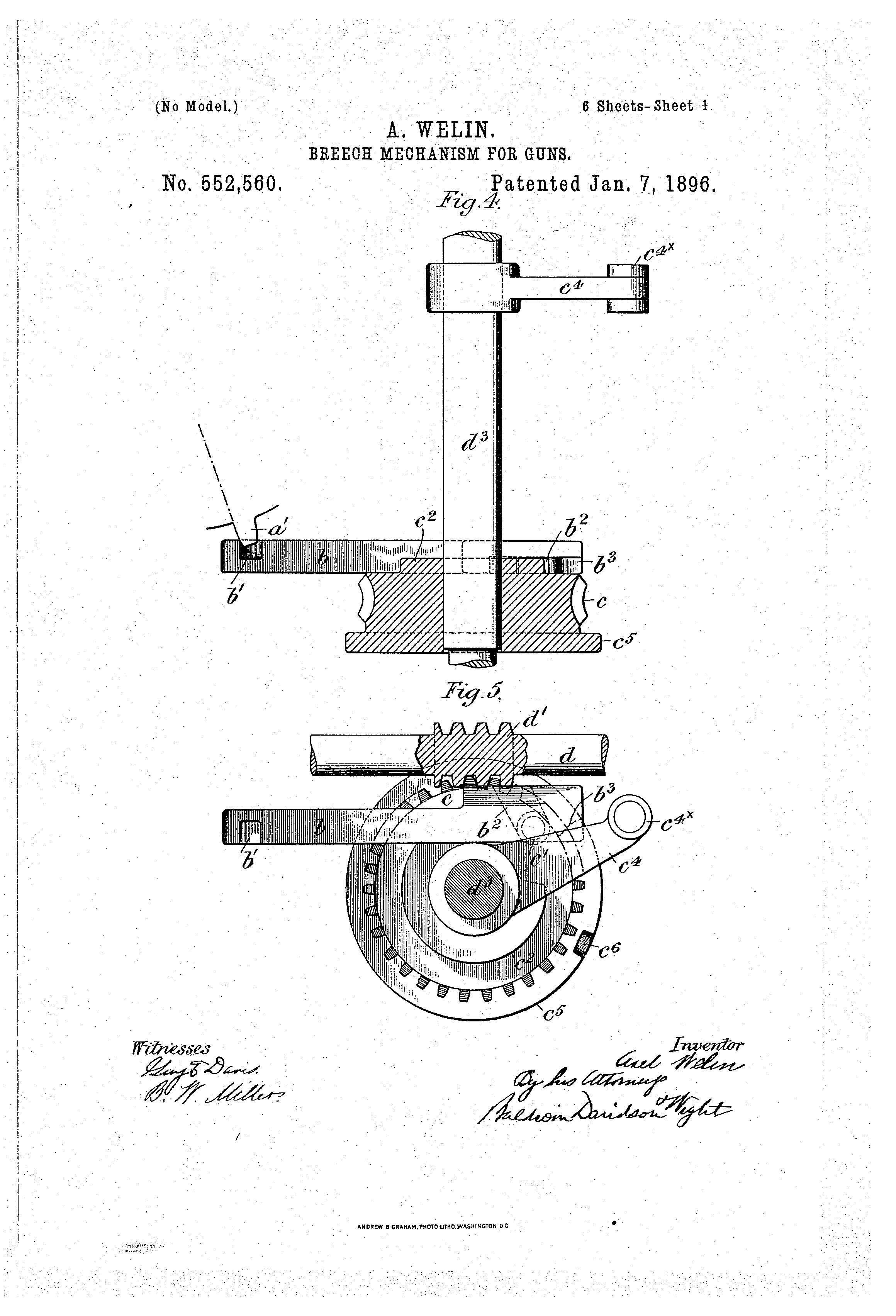

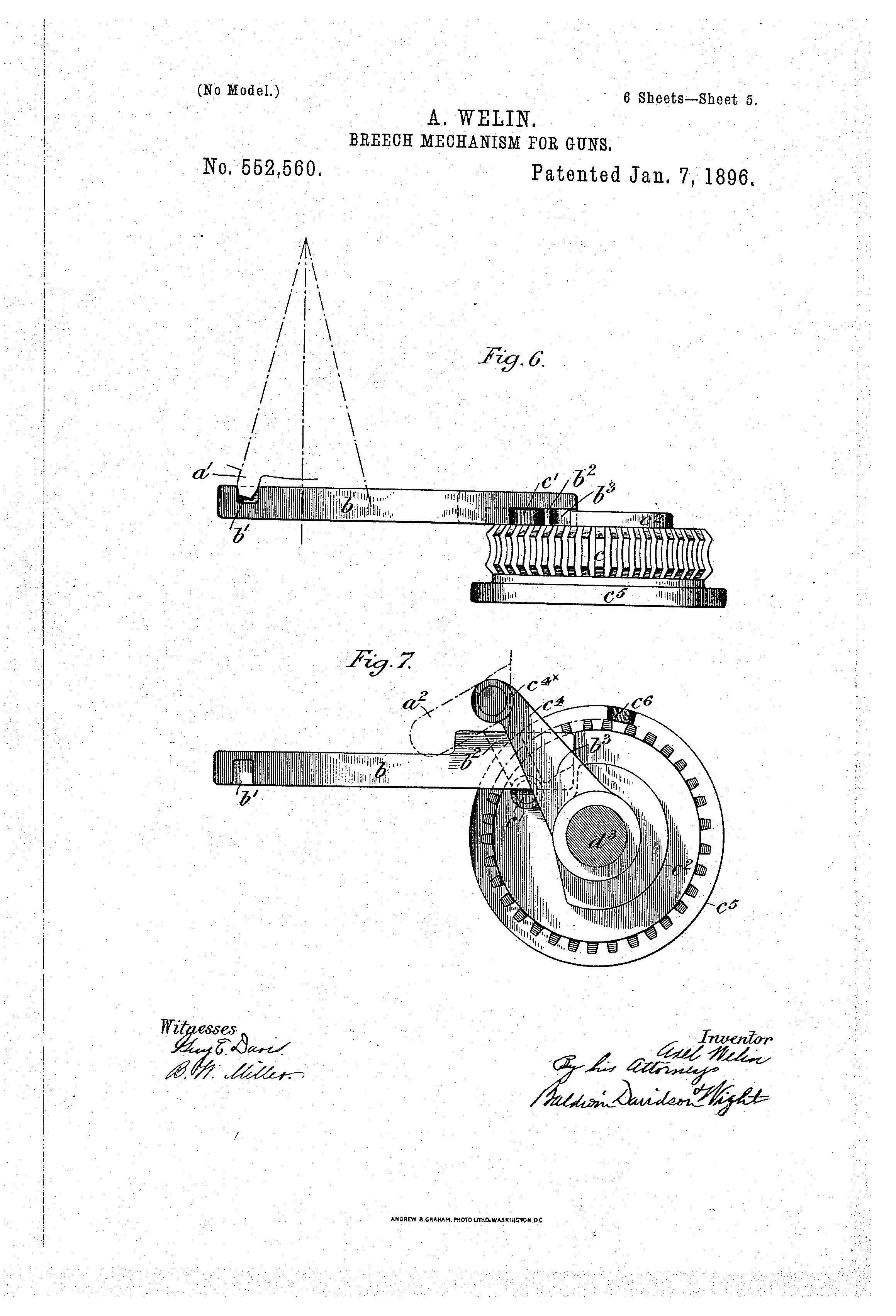

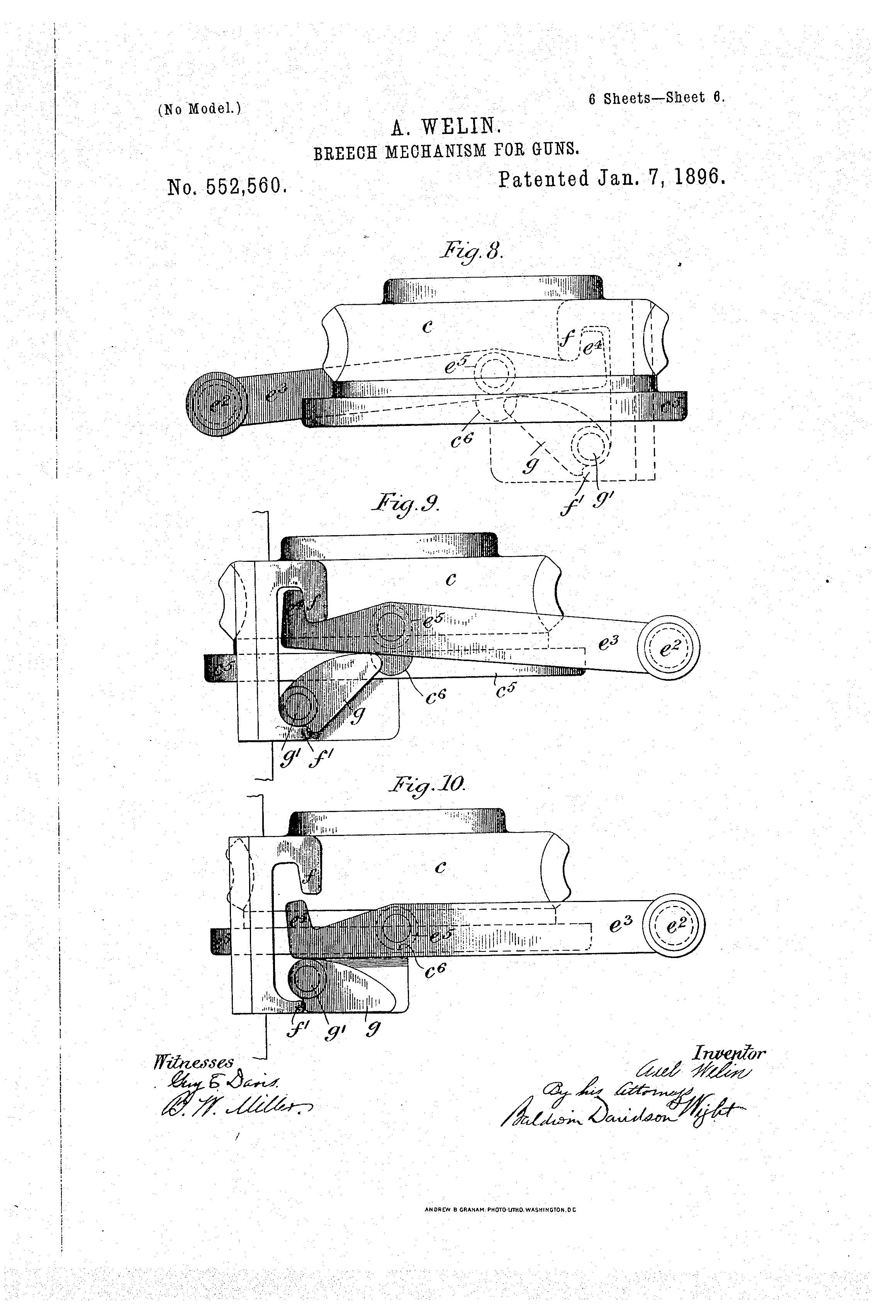

Patent of the Day: Breech Mechanism for Guns

On this day in 1896 the patent for Breech Mechanism for Guns was granted. U. S. Patent No. 552,560.

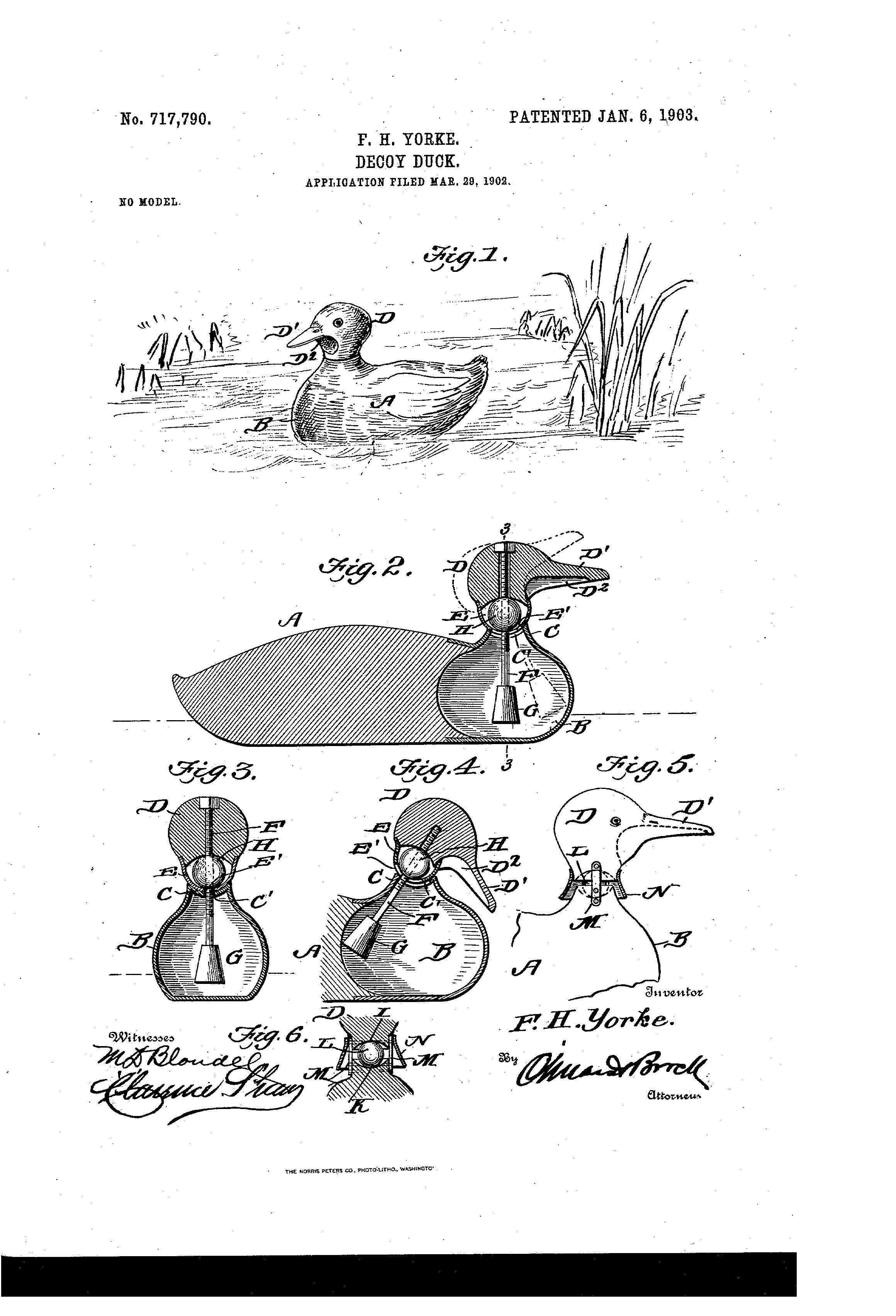

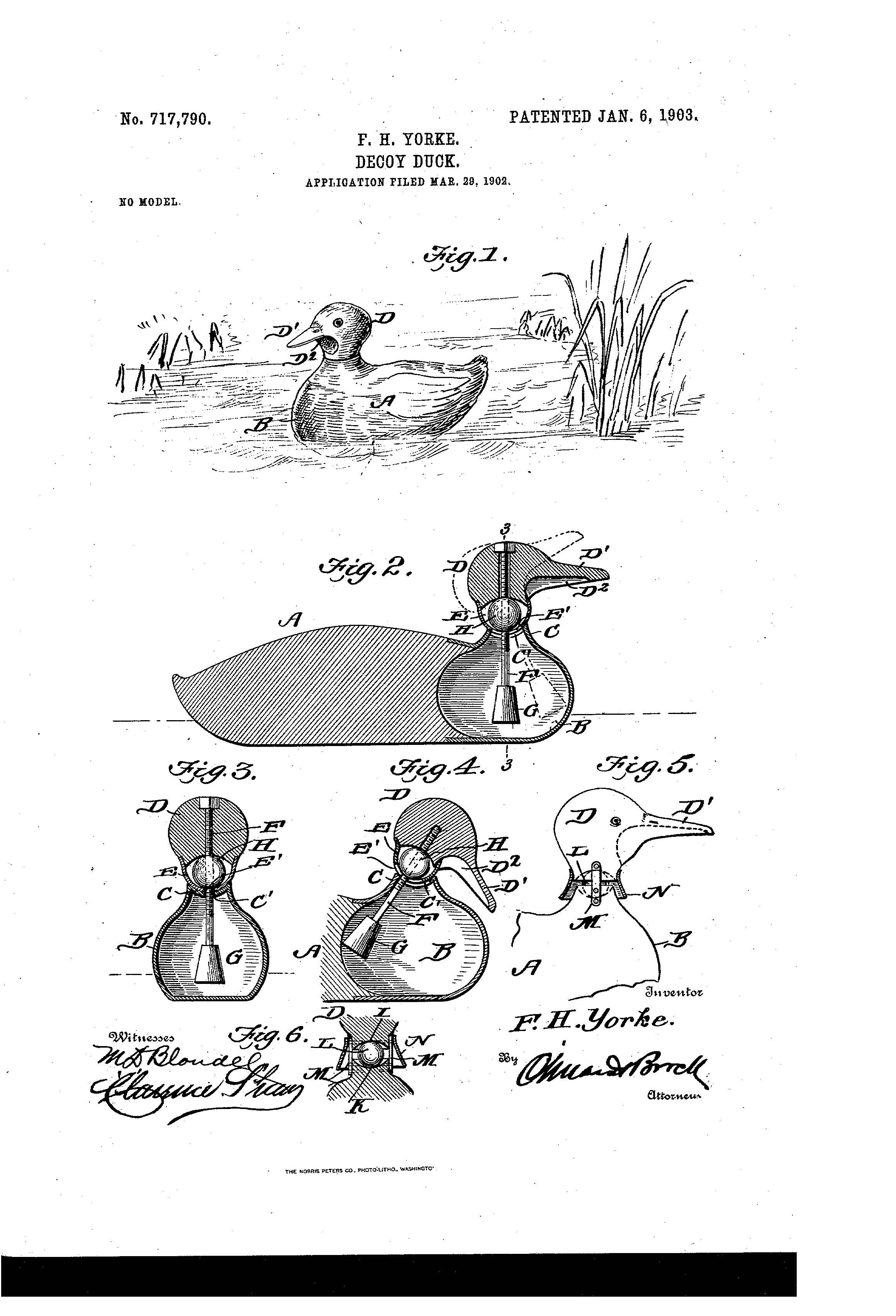

Patent of the Day: Decoy Duck

On this day in 1903 the patent for Decoy Duck was granted. U.S. Patent No. 717,790.

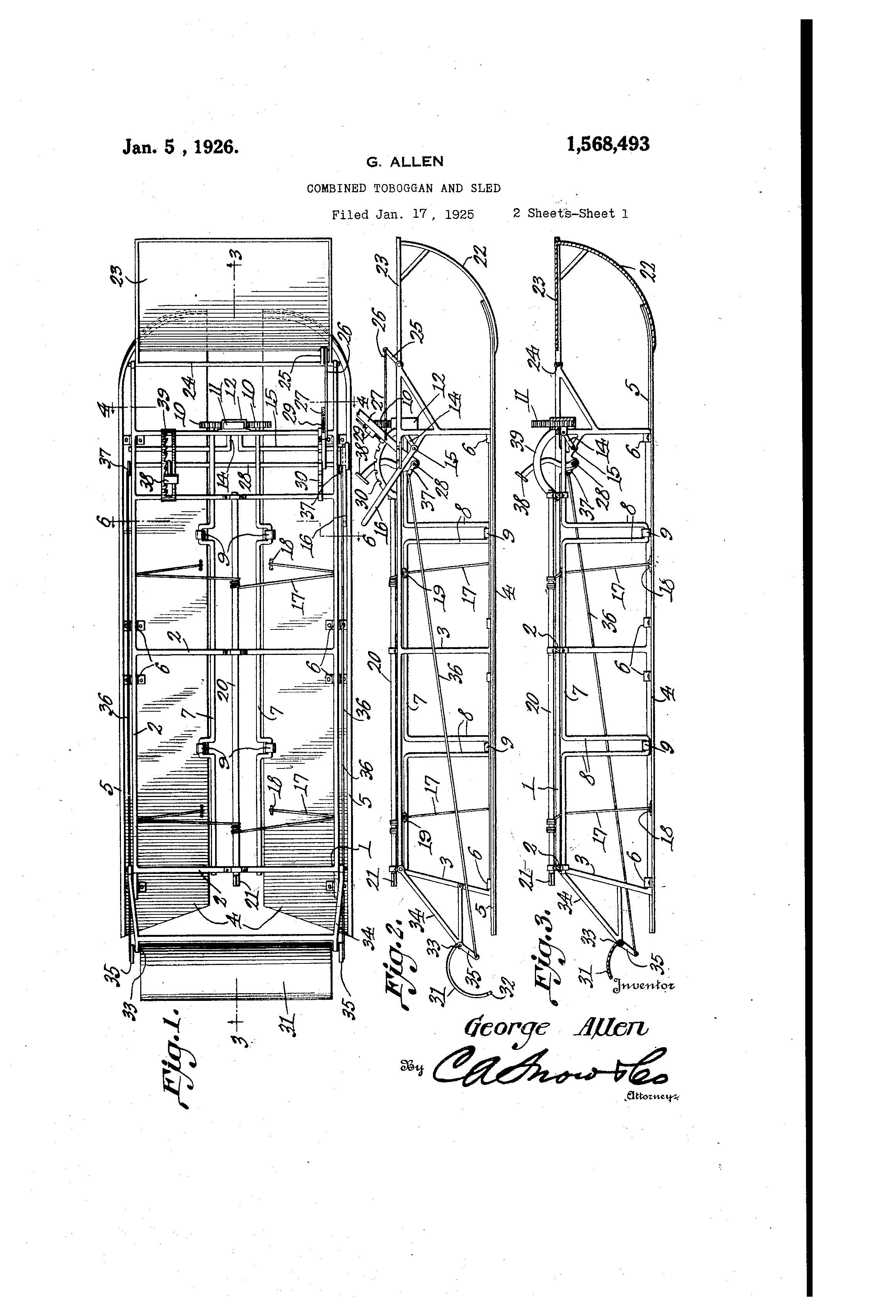

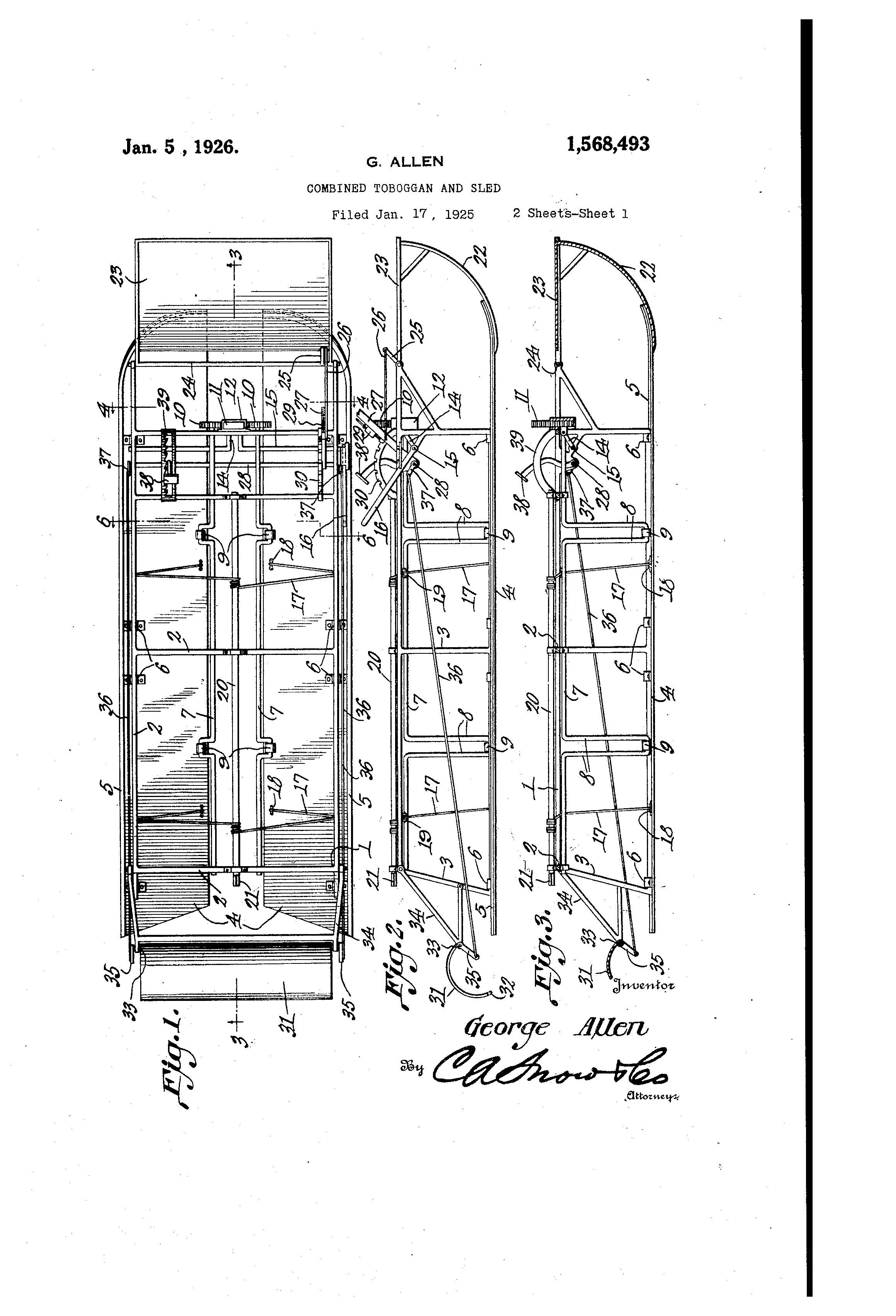

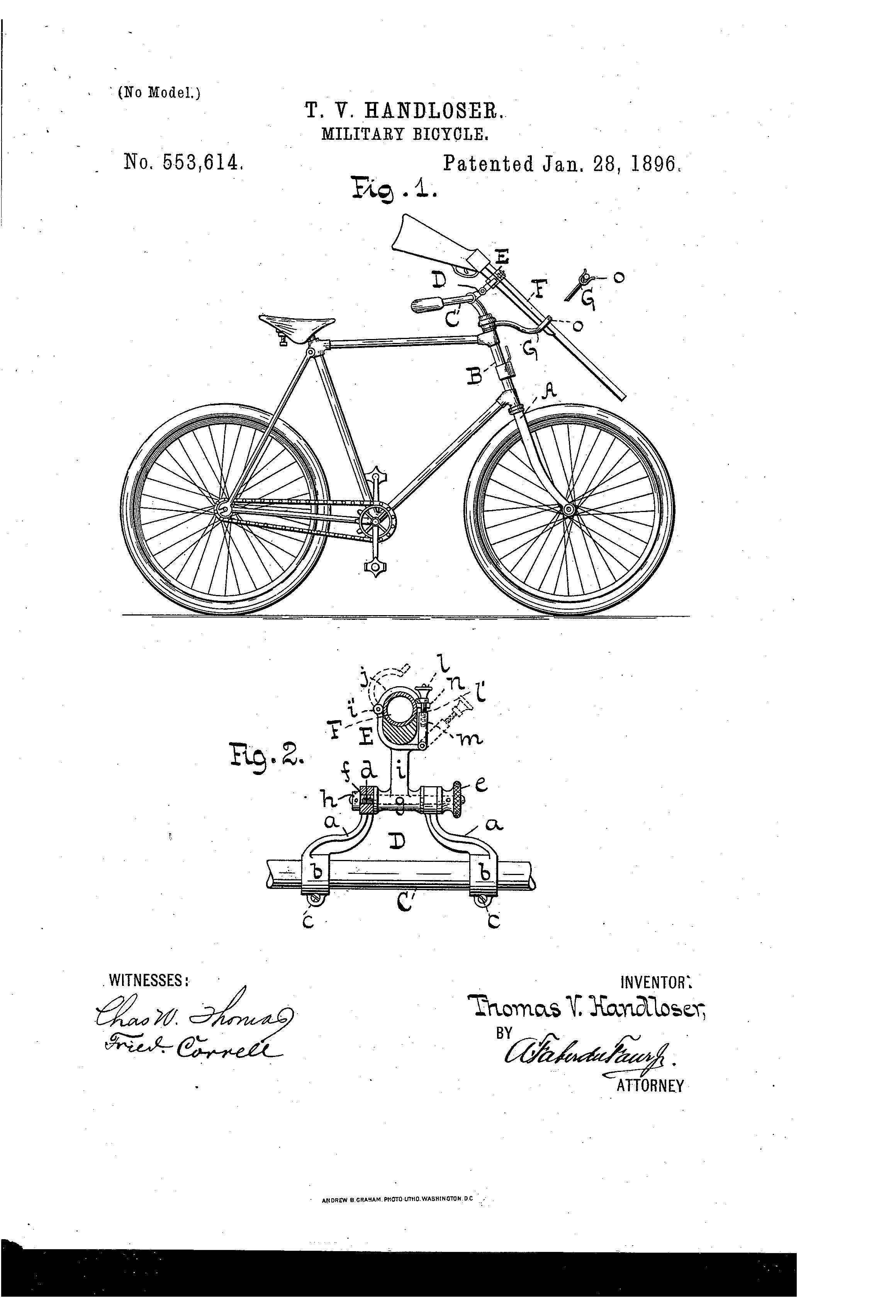

Patent of the Day: Combined Toboggan and Sled

On this day in 1926, the patent for Combined Toboggan and Sled was granted. U.S. Patent No. 1,568,493.

Diaper Drive 2015 Results

Thanks to everyone, this year, we were able to donate 2,195 diapers to the women and children of the Lydia House. Way to go!